来源:智堡

摘要

本次会议,美联储保持利率水平不变。

会议公布了新的经济预测,上调了对本年度的GDP增长预测与通胀预测。

点阵图变化焦灼,预计2024年降息3次(10位委员),未来两年的降息次数亦下降,但符合预期。

发布会鲍威尔重申本轮周期利率已经触顶,确认了在今年启动降息是合适的。

1月和2月的CPI数据并未改变鲍威尔对去通胀进程的乐观态度,他强调FOMC本就预期通胀回落不会一帆风顺(bumpy)。

对就业市场的强势表现,鲍威尔显得“毫无保留”,并强调就业过强不会影响降息决定。

有关长期利率预测近5年内的首次上行,鲍威尔表态“不知道具体水平在哪”但不会像疫情前那么低了。

对于QT Taper,联储已经开始讨论资产负债表的结构问题,鲍威尔强调了流动性的“分布”问题。

从观感上看,本次会议几乎没有展露出任何的鹰派信号,市场在会议前所担忧的二次通胀风险并未进入FOMC的视野。

笔者认为联储在开年会议上奠定的“风险管理”和“平衡风险”的姿态在本次会议上出现了bias,淡化了通胀风险,深化了对增长的乐观预期。

风险资产持续走高,10年期美债收益率冲高回落,美元跌。

声明原文(仅第一段有可忽略的小幅变化)

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

最近的指标表明经济活动以稳健的速度扩张。就业增长保持强劲,失业率保持低位。通胀在过去一年有所放缓,但仍然居高不下。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

委员会致力于实现在长期内充分就业和2%的通胀率。委员会认为实现就业和通胀目标的风险正在朝着更好的平衡方向发展。经济前景不确定,委员会对通胀风险保持高度关注。

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

为了支持其目标,委员会决定将联邦基金利率的目标区间维持在5.25%至5.5%之间。在考虑对联邦基金利率目标区间进行任何调整时,委员会将仔细评估最新数据、不断变化的前景和风险平衡。委员会预计在获得更大信心,即通胀朝着2%的可持续增长方向发展之前,降低目标区间将不合适。此外,委员会将继续按照其先前公布的计划减持国债、机构债务和机构抵押支持证券。委员会坚决致力于将通胀恢复到2%的目标水平。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在评估货币政策的适当立场时,委员会将继续监测经济前景的相关信息。如果出现可能阻碍委员会目标实现的风险,委员会将准备适时调整货币政策的立场。委员会的评估将考虑到广泛的信息,包括劳动力市场状况、通胀压力和通胀预期以及金融和国际发展情况。

点阵图与经济预测细节

经济预测上调,这都快跟高盛(乐观派)的预测差不多了

通胀预测小幅上调,体现去通胀并非坦途。

长期利率预测小幅上升10bp,疫情以来的首次。

从点阵图来看,实际上认为降息两次内的委员是9位,而认为降息两次以上的为10位,降息次数有进一步调降的风险。

此文由 比特币官网 编辑,未经允许不得转载!:首页 > 比特币挖矿 » 美联储议息会议笔记:通胀别慌 利率会降(2024年3月)

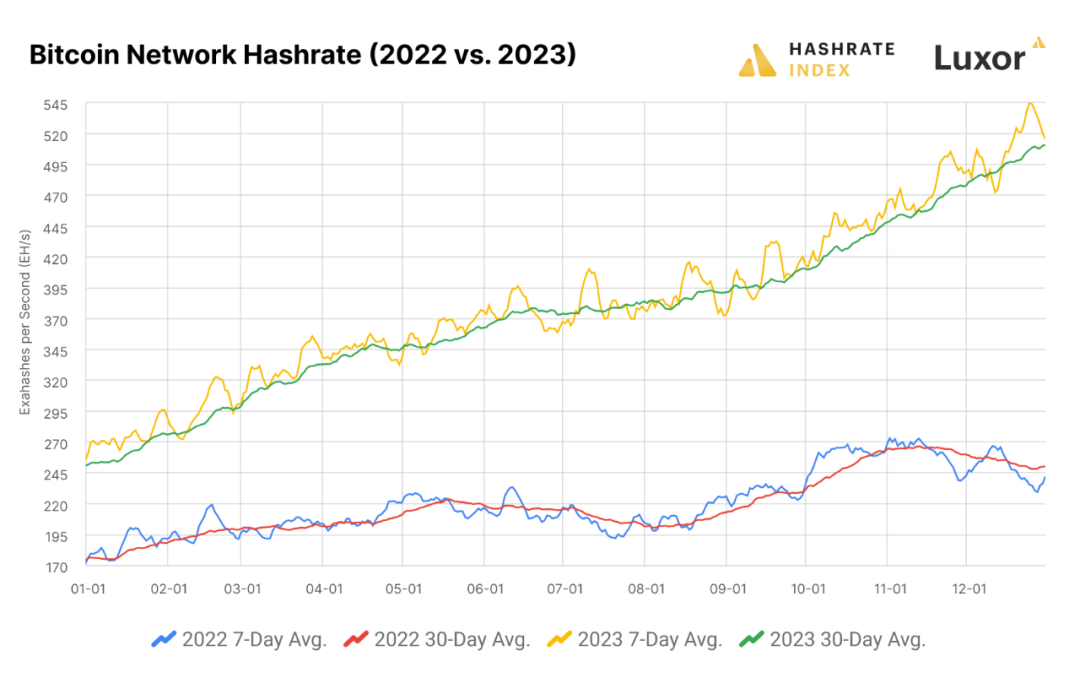

HashrateIndex:大逆转,回望 2023 年比特币矿业

HashrateIndex:大逆转,回望 2023 年比特币矿业 Cobo 神鱼:一个老矿工的挖矿往事

Cobo 神鱼:一个老矿工的挖矿往事 比特币矿商CleanSpark计划于今年推出内部交易平台

比特币矿商CleanSpark计划于今年推出内部交易平台 比特币挖矿公司Iris Energy冲刺美股:大批量采购最新矿机,连年亏损抢占算力

比特币挖矿公司Iris Energy冲刺美股:大批量采购最新矿机,连年亏损抢占算力 加拿大比特币挖矿业:回望 2023,展望 2024

加拿大比特币挖矿业:回望 2023,展望 2024 比特币减半 矿工何去何从?挖矿消耗150万户家庭用电量 一地成新“避难所”

比特币减半 矿工何去何从?挖矿消耗150万户家庭用电量 一地成新“避难所” 俄罗斯非法加密货币挖矿面临打击:中心关闭 设备被没收

俄罗斯非法加密货币挖矿面临打击:中心关闭 设备被没收 以太坊核心开发者会议纪要:坎昆升级日期确认

以太坊核心开发者会议纪要:坎昆升级日期确认 2024 年比特币减半:引领矿业转型

2024 年比特币减半:引领矿业转型 比特币挖矿难度昨日上调6.98%至72.01 T

比特币挖矿难度昨日上调6.98%至72.01 T CoinShares 挖矿报告:减半及其对算力和矿工成本结构的影响

CoinShares 挖矿报告:减半及其对算力和矿工成本结构的影响 NOSS:挖了半天,其实自己是矿?「BTC生态」

NOSS:挖了半天,其实自己是矿?「BTC生态」